|

poradna o diabetes (= cukrovka)

odpověď na Vaše otázky o diabetes

|

TIP: Používáte inzulínovou pumpu? Navštivte komunitní web www.pumpari.cz, naleznete zde nejnovější informace o všech inzulínových pumpách dostupných v ČR.

| Zobrazit předchozí téma :: Zobrazit následující téma |

| Autor |

Zpráva |

FrankJScott

Založen: 26.2.2021

Příspěvky: 4975

Bydliště: Czech Gold Coin

|

Zaslal: út leden 31, 2023 7:53 pm Předmět: Good Tips For Selecting Crypto Trading Zaslal: út leden 31, 2023 7:53 pm Předmět: Good Tips For Selecting Crypto Trading |

|

|

What Are The Most Important Factors That Can Be Used To Determine Rsi Divergence?

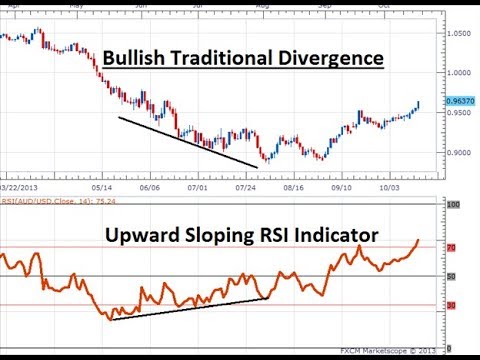

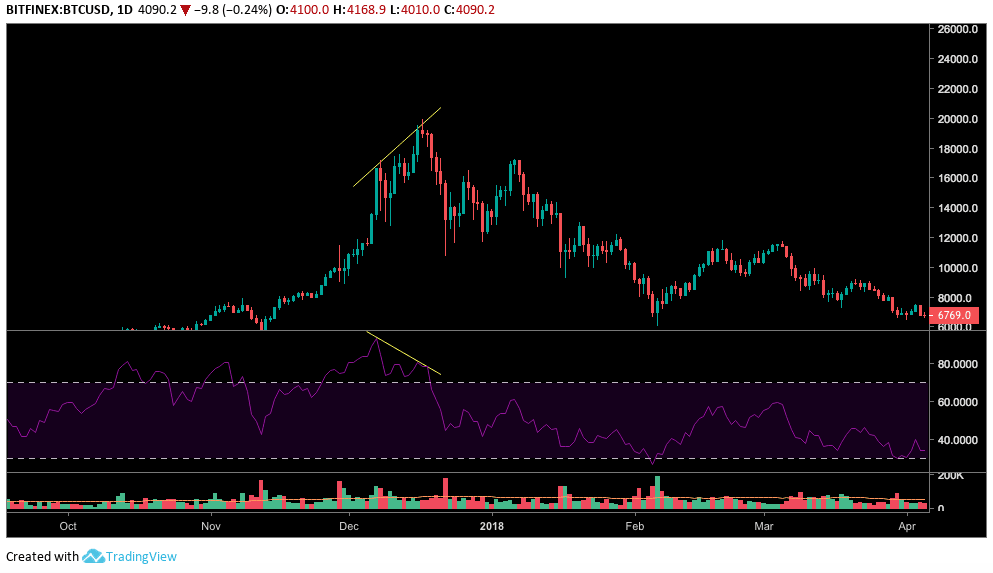

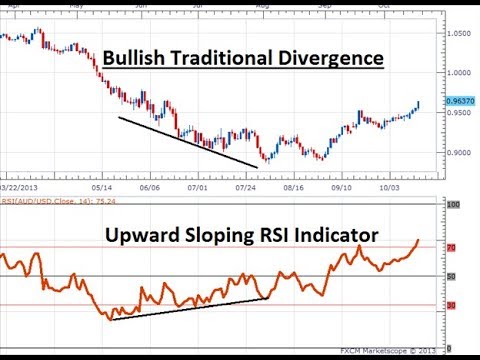

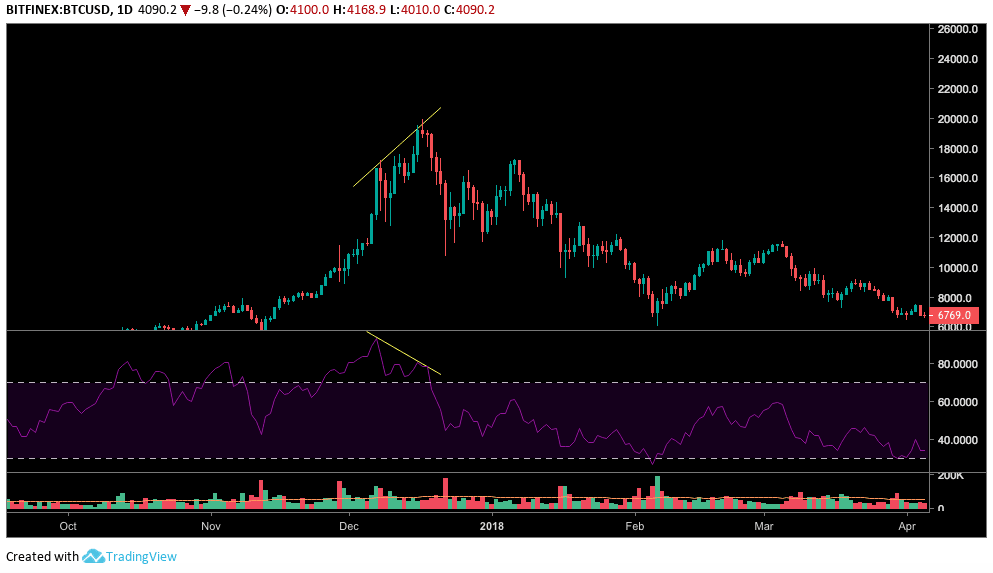

Definition: RSI diversence is a technical analysis tool which compares the direction that the prices of an asset change against the index of relative strength (RSI).

Signal A positive RSI divergence is an upward signal. Negative RSI divergence signals a bearish signal.

Trend Reversal: RSI divergence could indicate the possibility of a trend reversal.

Confirmation RSI divergence may be used to verify other methods of analysis.

Timeframe: RSI diversification can be viewed using different time frames in order to get different perspectives.

Overbought/Oversold RSI values above 70 indicate overbought, and values below 30 mean that the stock is oversold.

Interpretation: To read RSI divergence correctly, you need to consider other fundamental and technical factors. Check out the recommended cryptocurrency trading for site recommendations including best forex trading platform, automated trading software, best crypto trading platform, forex backtesting software free, trading platform cryptocurrency, crypto trading backtesting, backtesting platform, backtesting tool, position sizing calculator, trading platforms and more.

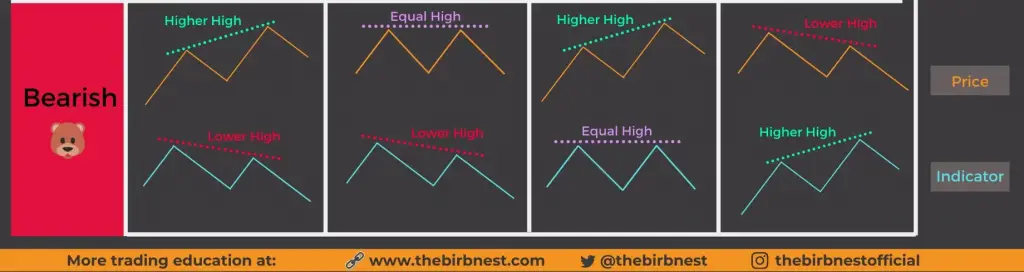

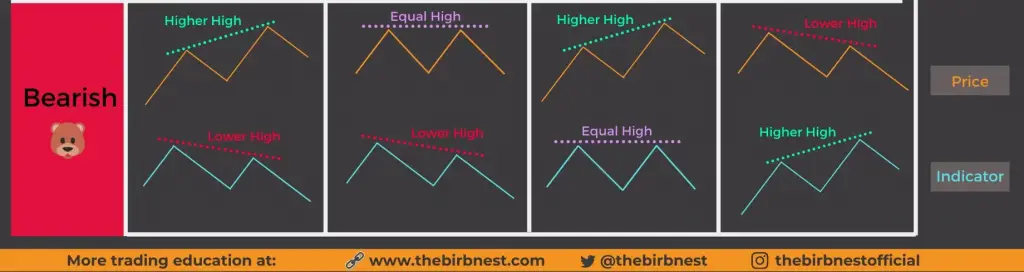

What Is The Difference Of Regular Divergence And Concealed Divergence?

Regular Divergence - This happens when the asset's price hits the upper or lower levels than the RSI. It could be a sign of a trend reversal. However, it is important to consider other factors, both fundamental and technical. This indicates that a trend reverse could be possible even though it's less robust than regular divergence.

To be informed of technical issues:

Trend lines and support/resistance levels

Volume levels

Moving averages

Other indicators and oscillators

Important aspects to take into consideration:

Economic data released

Specific news for companies

Market sentiment and mood indicators

Global Market Events and Impact on the Market

Before making investment decisions based only on RSI divergence indicators, you must be aware of both fundamental and technical factors. Have a look at the top rated automated trading bot for site advice including RSI divergence, software for automated trading, crypto trading backtesting, forex trading, software for automated trading, software for automated trading, automated trading platform, backtesting tool, forex backtesting software free, crypto backtesting and more.

What Are Backtesting Strategies For Trading Crypto?

Backtesting crypto trading strategies is testing the effectiveness of a trading plan using historical data in order to determine its profitability. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy Definition of the trading strategy being tested with regard to entry and exit rules, position sizing, and risk management guidelines.

Simulation: Use software to simulate the application of the trading strategy on the data from the past. This lets one see how the strategy would be performing in the past.

Metrics. Use metrics such as profitability and Sharpe ratio to determine the effectiveness of the strategy.

Optimization: Adjust the strategy's parameters and run the simulation again to optimize the strategy’s performance.

Validation: Examine the effectiveness of your strategy by using out-of-sample information to verify its reliability.

Be aware that past performance does not always guarantee future results. Results from backtesting can't be relied upon as an assurance of future returns. When applying the method for live trading it's essential to be aware of the market's volatility, transaction costs, and other real-world considerations. Read the top rated automated trading for blog examples including backtesting tool, backtesting, RSI divergence, crypto trading backtester, bot for crypto trading, trading platform cryptocurrency, backtesting platform, crypto trading, trading platform crypto, forex backtest software and more.

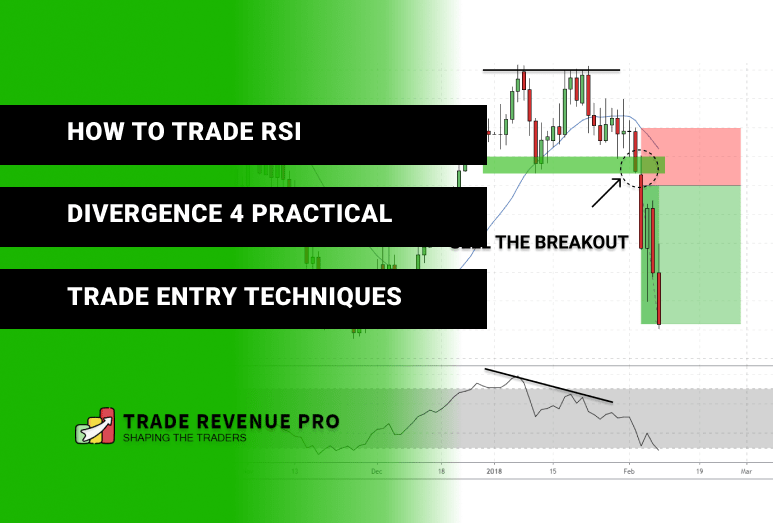

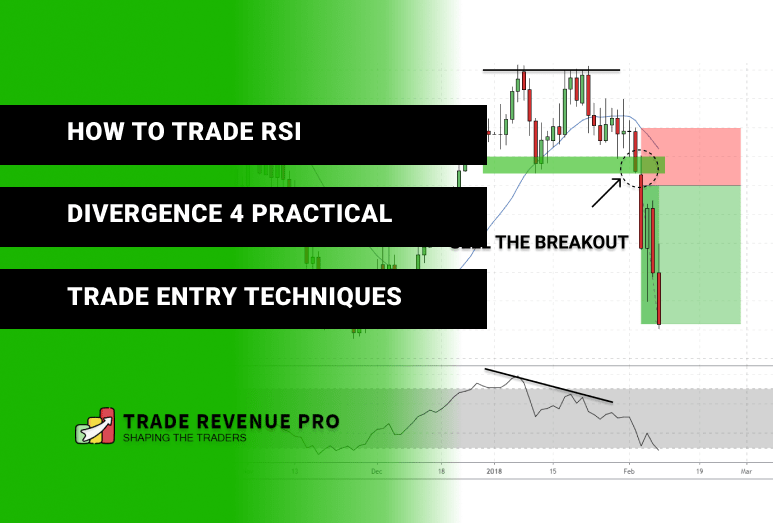

What Can You Do To Review The Forex Backtesting Software When Trading Using Divergence

When examining forex backtesting software to trade with RSI divergence, the following aspects should be taken into consideration: Data Accuracy: Ensure the software has access to high-quality, accurate historical data for the forex pairs being traded.

Flexible: The software should permit the customization and testing of various RSI trading strategies for divergence.

Metrics : The program should contain a variety of metrics that can be used to evaluate the effectiveness of RSI Divergence Trading Strategies, such as profit, risk/reward, and drawdown.

Speed: The software must be fast and efficient that allows for rapid testing of various strategies.

User-Friendliness: The program should be user-friendly and easy to understand, even for those who do not have a deep understanding of technical analysis.

Cost: Take into consideration the cost of the software, and whether it is in your budget.

Support: The software should come with good customer support, including tutorials as well as technical assistance.

Integration: The software has to be able to work with other trading programs such as charting programs or trading platforms.

It is essential to test the software by using the demo account prior to purchasing a subscription. This will allow you to make sure that it meets your needs and are comfortable using the software. Have a look at the recommended cryptocurrency trading bot for site recommendations including backtesting, crypto trading backtesting, backtesting trading strategies, automated cryptocurrency trading, trading divergences, trading platform, RSI divergence cheat sheet, crypto trading, cryptocurrency trading, trading platform cryptocurrency and more.

How Can Automated Trading Software Integrate With Bots For Trading Cryptocurrency?

The bots for trading cryptocurrency work within automated trading software, following an established set of guidelines and making trades on behalf of the user. The following is the basic strategy: The user determines a trading plan, which includes the criteria for entry and exit, position sizing, risk management, and risk management.

Integration: Through APIs, the trading bot can be integrated with cryptocurrency exchanges. This allows it to get real-time market information and then execute trades.

Algorithm is an algorithm that bots use to analyze market data to make decisions based mostly on the trading strategy.

Execution Automated execution: The bot executes trades in accordance with the rules set in the trading strategy, without the need for manual intervention.

Monitoring: The bot continuously analyzes market activity and makes necessary adjustments to strategies for trading. See the recommended position sizing calculator for blog advice including trading with divergence, automated crypto trading, forex backtest software, RSI divergence cheat sheet, best crypto trading platform, trading platform cryptocurrency, forex backtesting software free, automated trading bot, forex tester, crypto trading bot and more.

Bots that trade in cryptocurrency can be utilized to execute repetitive or complicated trading strategies. This reduces the need for intervention from a manual standpoint and allows users to profit from market opportunities 24-7. However, it's important to understand that automated trading has its own set of risks, including the potential for software errors as well as security flaws, and losing control over the trading choices. Before you begin trading in real time, be sure to thoroughly test and evaluate the trading bot. |

|

| Návrat nahoru |

|

|

|

|

Nemůžete odesílat nové téma do tohoto fóra.

Nemůžete odpovídat na témata v tomto fóru.

Nemůžete upravovat své příspěvky v tomto fóru.

Nemůžete mazat své příspěvky v tomto fóru.

Nemůžete hlasovat v tomto fóru.

|

|