|

poradna o diabetes (= cukrovka)

odpověď na Vaše otázky o diabetes

|

TIP: Používáte inzulínovou pumpu? Navštivte komunitní web www.pumpari.cz, naleznete zde nejnovější informace o všech inzulínových pumpách dostupných v ČR.

| Zobrazit předchozí téma :: Zobrazit následující téma |

| Autor |

Zpráva |

FrankJScott

Založen: 26.2.2021

Příspěvky: 5004

Bydliště: 스포츠 관련 정보

|

Zaslal: st březen 08, 2023 9:08 am Předmět: Free Ideas For Choosing Automated Trading Macryt Zaslal: st březen 08, 2023 9:08 am Předmět: Free Ideas For Choosing Automated Trading Macryt |

|

|

What Exactly Is Automated Forex Trade And What Are The Best Strategies To Use?

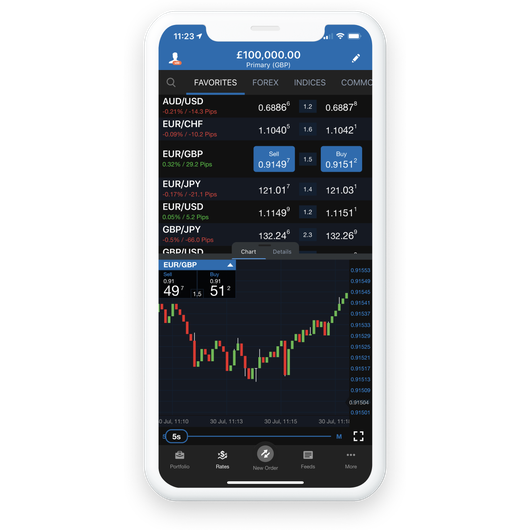

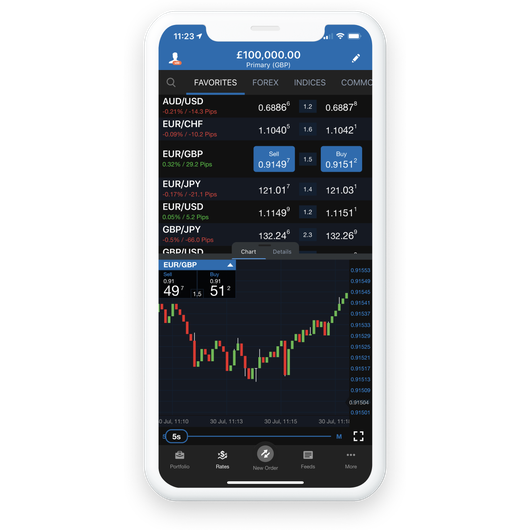

Automated Forex trades are conducted using computer software, or trading algorithms. These programs are programmed to adhere to specific rules of trading that aim to maximize profits and minimize loss.

There are numerous trusted and reliable automated trading programs available. It is crucial to select an appropriate software with an excellent track record and can be utilized with your trading needs.

Create a strategy for trading. Before you start automating trading, it's essential to develop a clear and concise trading plan. This includes identifying the market conditions in which you want to trade and deciding on entry and exit points, and setting stop-loss orders.

Utilize a risk management program A reliable automated trading system should include a risk management system to reduce the chance of losses. This may include setting a limits on the amount of stop-loss orders and the amount of money that can be traded simultaneously.

You should test your strategy by using data from the past. This will help you find any weaknesses in your strategy, and then make adjustments.

Automated trading saves time. However, you should monitor your system regularly to ensure that it runs well and make any adjustments that are needed.

Stay up-to-date with market conditions: To succeed in automated Forex trading, you need to keep up-to-date with market conditions and adapt your strategy in line with them.

Overall an automated system that is successful Forex trading requires a combination of dependable software, a clearly-defined trading strategy and a well-designed risk management system and ongoing checking and adjustments. Take a look at the best crypto trading bot url for website examples including ibkr cryptocurrency, robo trade program, best app to buy and sell crypto, forex forum for beginners, automated investing platform, shiba inu trading platform, crypto auto trading, mt4 cryptocurrency, gps forex robot forum, coin arbitrage, and more.

What Forex Backtesting Tools Are Available And How Best To Utilize Them?

There are several forex backtesting software options available, each with its own unique characteristics and capabilities. MetaTrader 4 and MetaTrader 5 are two popular options. MetaTrader 4 is a well-known forex trading platform. It comes with an option to test strategy that permits back-testing of trading strategies. It allows traders to analyze historical data to optimize settings and test their strategies.

TradingView: This is an online charting and analytics platform with an option for backtesting. It lets traders utilize their Pine Script programming interface to develop and test strategies.

Forex Tester is a standalone program that can be used to test forex trading strategies. You can simulate different markets, and test multiple strategies at the same time.

QuantConnect is a cloud-based platform that permits traders to test forex and other trading strategies by using various languages, like C# and Python.

These steps are required to make use of the software Forex backtesting at its best.

Define your trading strategy. Before you can start backtesting, you need to determine the rules and the criteria you'll use to trade both in and out. This might include technical indicators or chart patterns.

Set up the backtest: Once your strategy is established it is possible to create the backtest in the software you prefer. This usually means choosing the currency pair you'd like and setting the timeframe and any other specific parameters to your strategy.

Run the backtest: Once you've setup the backtest, you can run it to see how your strategy performed in the past. The software for backtesting will produce a report that shows the results of your trades, including profit and loss, win/loss ratio, and other performance metrics.

Analyze the results: After having run the backtest, can analyze the results to assess the effectiveness of your strategy. The results of the backtest can help you adjust your strategy and improve its performance.

Testing the strategy ahead of time: Once you've made any adjustments to your strategy you'll be able to test it forward using the demo account or the real money. You'll be able to observe how it performs in real-time trading conditions.

By using forex backtesting software, you can gain valuable insights into how your strategy might have performed in the past, and use this information to enhance your trading strategy going forward. See the best this hyperlink about backtesting platform for website info including robinhood crypto fees, swing trading forum, most popular crypto exchanges, free day trading chat rooms, ai auto trading, day trading on binance reddit, asian crypto exchanges, forex auto trading bot, charles schwab automated trading, automated day trading bot, and more.

What Is An Automated Trading Platform?

A robot that trades automatically is a computer program that executes trades for the trader based on pre-determined rules. They can analyse market information (such as price charts or technical indicators) and then place trades based on the strategies and rules the trader has established. They are able to executed on various platforms and programming languages, according to the platform and language they are written in. The most popular programming languages used by automated trading bots are Python, Java, and C++. The specific software or platform used will depend on the preferences of the trader as well as the integration with the platform for trading.

These platforms and software may be used to develop automated trading bots:

MetaTrader is a popular trading platform that permits traders to develop automated trading robots by using the MQL programming interface.

TradingView: This platform allows traders to develop and test trading strategies using their Pine Script programming language.

Cryptohopper is a platform that allows automated trading of cryptocurrency. The platform permits traders to create and backtest bots based on historic data.

Zenbot: Zenbot can be customized on any platform such as Windows, macOS or Linux.

Python-based languages: There exist several Python libraries, like PyAlgoTrade and Backtrader that give traders to develop and run robots for trading that are automated.

Overall, the choice of platform and software will depend on the preferences of traders and their technical expertise and compatibility with trading platforms and exchanges. See the top rated description on rsi divergence cheat sheet for blog info including foreign exchange autotrading, algo trading forum, kraken futures fees, bots automated trading reddit, robot trading autotrade, coinbase auto trading, tiger broker edmw, top 10 exchange cryptocurrency, automated forex trading reddit, automated forex trading robot for android, and more.

How Can You Analyse Backtesting Results To Assess The Effectiveness Of A Trading Plan?

Analyzing backtesting outcomes is critical to determine the financial viability of a trading strategy. In order to analyse the backtesting results, you follow these steps in calculating performance indicators. This is the first step in analysing results from backtesting. This involves formulating performance metrics, such as the total return, the average return, and the maximum drawdown. These metrics provide an insights into the effectiveness of the trading strategy as well as the potential risk.

Compare to benchmarks. This allows you to compare the performance of your trading strategy against benchmarks such as S&P 500 or market indexes. It also gives an indication of how well it performed in comparison to the broader market.

Assess risk management methods: Analyse the risk management techniques used within the trading strategy, such as stop-loss orders or position sizing to assess their efficiency in reducing loss.

You should look out for trends. Review the strategy's results in time to spot patterns or trends. This can help you determine areas that could need to be adjusted.

Review market conditions: Assess the effectiveness of the strategy in different market situations during the backtesting phase.

Backtest with different parameters: Backtest the strategy with various parameters, such as rules for entry and exit, or risk management strategies, to see how the strategy performs under various circumstances.

Modify the strategy as needed: Based upon the analysis of backtesting, you can modify the strategy in order to increase its effectiveness and reduce risk.

In the end, analysing the results of backtesting requires a thorough review of results measures, risk management strategies as well as market conditions and other factors that can influence the profit and risk of a trading strategy. Backtesting results are an excellent way for traders to identify areas to improve and adjust their strategies accordingly. Take a look at the top super fast reply for automated trading bot for site advice including free ea forex robot, fibonacci crypto, binance trading app, babypips reddit, top ea robot forex, futures chat room, copykat autotrading system, best auto trading robot 2020, pionex exchange, crypto trading discord, and more.

What Do You Make An Automated Trading System Reduce Losses By Incorporating A Risk Management Program?

A good automated trading system incorporates a risk management system to minimize potential losses by incorporating several key elements: Stop Loss Orders: The system that is automated should have a built-in stop-loss order which can be used to automatically close out the position once it has reached an amount that is predetermined. This will stop the system from retaining an unprofitable position and limit potential losses.

Position Sizing Position Sizing: A position sizing algorithm should be integrated into any trading system. It will determine the size of each trade based on the trader's risk tolerance and their account size. This helps to minimize loss and ensure that trades are not too large relative to account balance.

Risk-toreward Ratio: An automated trading platform will analyze the risk-to-reward ratio of each trade. Only take trades that are favorable with regard to risk-to-reward. This means that the possible profit from a trade should exceed the risk of losing. This can help reduce the risk of losing more.

Risk Limits The trading system must include risk limits, which are predetermined amounts of risk the system is prepared to accept. This could help in preventing the system from taking risks that are too high and causing large losses.

Backtesting and Optimization: The automated trading system should be thoroughly tested and optimized in order to be able to function effectively under various market conditions. This will allow you to find weaknesses and then adapt it to minimize possible losses.

In the end, a successful automated trading system includes an effective risk management system that incorporates stop-loss orders, positionsizing, risk-to-reward ratios, risk limits, and backtesting and optimization. These elements will help reduce risk of losses and boost the overall performance. View the top rated rsi divergence cheat sheet for website recommendations including best platform to trade crypto, auto trading bot for binance, auto buy sell binance, automated trading webull, day trading altcoins, pros binance, trabot automated trading, top cryptocurrency exchange, whitelabel crypto exchange, reddit best crypto trading platform, and more.

[youtube]ye3nUsbegGI[/youtube] |

|

| Návrat nahoru |

|

|

|

|

Nemůžete odesílat nové téma do tohoto fóra.

Nemůžete odpovídat na témata v tomto fóru.

Nemůžete upravovat své příspěvky v tomto fóru.

Nemůžete mazat své příspěvky v tomto fóru.

Nemůžete hlasovat v tomto fóru.

|

|