|

poradna o diabetes (= cukrovka)

odpověď na Vaše otázky o diabetes

|

TIP: Používáte inzulínovou pumpu? Navštivte komunitní web www.pumpari.cz, naleznete zde nejnovější informace o všech inzulínových pumpách dostupných v ČR.

| Zobrazit předchozí téma :: Zobrazit následující téma |

| Autor |

Zpráva |

FrankJScott

Založen: 26.2.2021

Příspěvky: 5000

Bydliště: 스포츠 관련 정보

|

Zaslal: út březen 07, 2023 7:39 pm Předmět: Best Ideas For Picking Automated Trading Macryt Zaslal: út březen 07, 2023 7:39 pm Předmět: Best Ideas For Picking Automated Trading Macryt |

|

|

What Exactly Is Automated Forex, And What Strategies And Techniques Should One Employ?

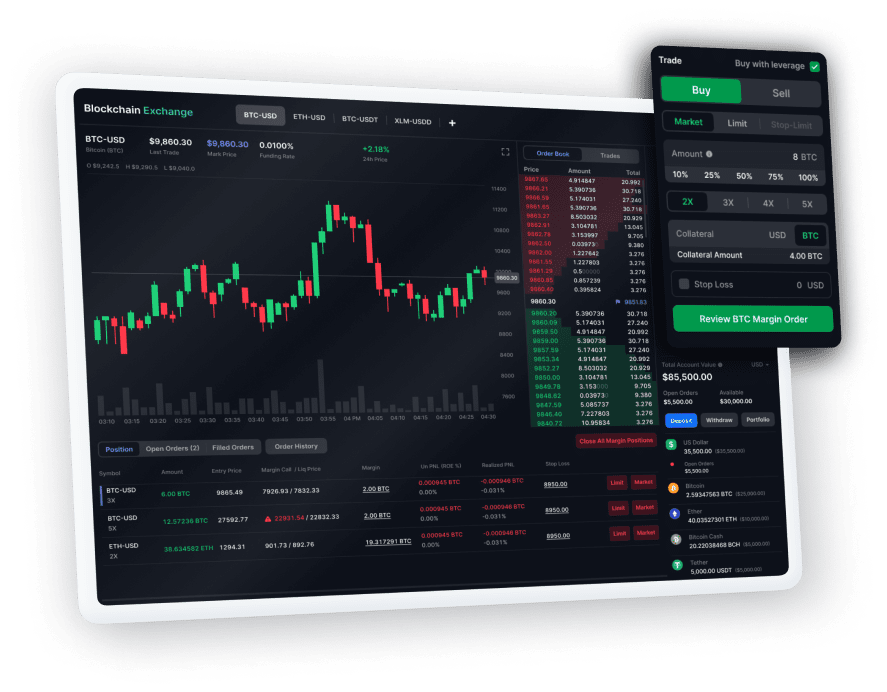

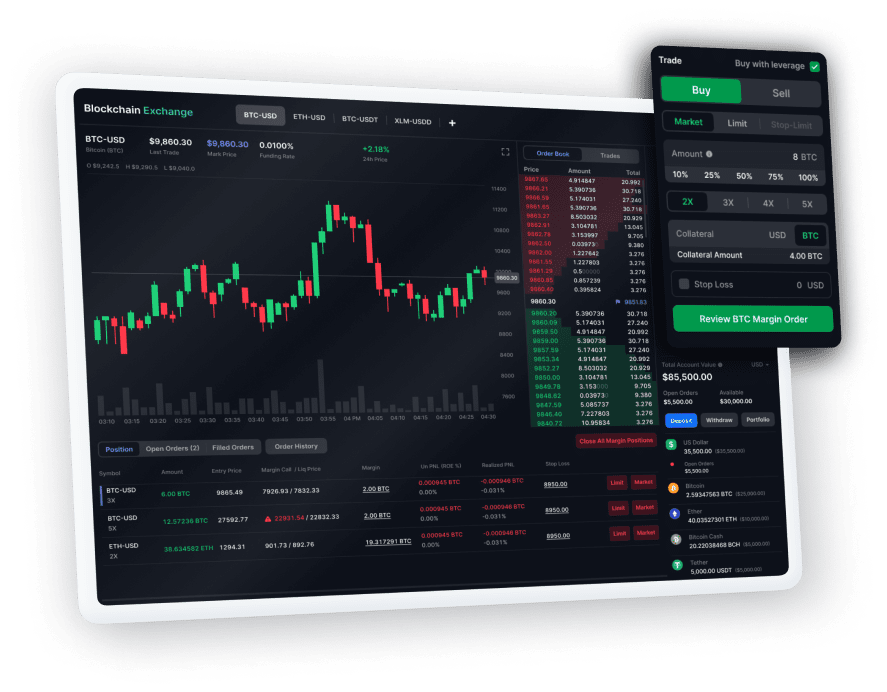

Automated Forex trading is the use of computer software or trading algorithms that execute trades in the market for foreign exchange. These programs are programmed to adhere to specific rules of trading in order to maximize profits and reduce losses.

Choose a trustworthy automated trading program There are a variety of automated trading software on the market. It is essential to choose a trustworthy one with a proven track record and that is compatible with your needs in trading.

Create a strategy for trading It's essential to have an established trading strategy prior to starting automated trading. This means determining the conditions of the market in which you want to trade, deciding upon entry and exit points and setting the stop-loss and order setting.

Management of risk: In order to reduce losses, a computerized trading system must incorporate a risk control system. This includes setting stop-loss and limit trades.

You should test your strategy with historical data. This will allow for you to identify and correct any flaws in your strategy.

Automated trading can be time-saving. However, it is essential to monitor your system regularly to make sure it's running well and make any adjustments that are necessary.

Stay current on market conditions: In order to be successful with automated Forex trading, you must to be aware of market conditions at the moment and adjust your strategy to them.

Automated Forex trading is possible only when a reliable program is employed The strategy to trade is clearly defined Risk management is effective and there are regular adjustments and monitoring. Have a look at the top homepage for automated trading for website examples including auto day trading, penny stock trading forum, arab forex forum, canadian day traders forum, automated stock screener, primexbt, auto robot trading tool, voyager fees crypto, best trading chat rooms, automated scalping strategies, and more.

How Can You Assess The Effectiveness Of Forex Backtest Software When Trading That Involves Divergence

If you are looking at backtesting software for the forex market, make sure it has access to the historical data which is accurate and of high-quality for the currency pairs that are being traded.

Flexibility: The software should permit customizing and testing different RSI trading strategies.

Metrics: The software should provide a range of metrics to evaluate the performance of RSI diversification strategies for trading that include the ratio of risk/reward, profitability, drawdowns, as well as other pertinent metrics.

Speed: Software must be quick and efficient to enable rapid backtesting of multiple strategies.

User-Friendliness. Even for people who do not have a lot of technical analysis knowledge it is essential that the program be easy to use.

Cost: Consider the cost of the software and whether it is within your budget.

Support: The software must provide good customer service, which includes tutorials and technical assistance.

Integration: The software should be able to integrate with other tools for trading, such as charting software or trading platforms.

Before you purchase a subscription, it's important to test the software first. View the top rated read review for bot for crypto trading for more advice including the best place to buy cryptocurrency, demo trading crypto, best day trading forums, robot trading crypto binance, best platform for crypto day trading, automated binance trading, trading strategy forum, digital currency trading platform, price action automated trading, quantitative trading forum, and more.

[img]https://www.datocms-assets.com/7756/1599426641-bitcoin-2643159.jpg?auto\u003denhance%2Cformat\u0026h\u003d630\u0026w\u003d1200[/img]

What Is A Cryptocurrency Trading Backtester? How Can It Be Integrated In Your Plan Of Action?

A crypto trading backtester is a software that allows users to test their trading plan against historic cryptocurrency price data to assess how it performed over time. It can be used to test the effectiveness and risk-free trading strategies.

Choose a backtesting system. There are numerous platforms that allow you to backtest crypto trading strategies such as TradingView and Backtest Rookies. Select the best platform to suit your needs and your budget.

Determine your strategy for trading. Before you back-test it, you must establish the rules you'll use for entering and exiting trades. These could include technical indicators such as Bollinger Bands or moving averages.

Begin the backtest. Once you've developed your trading strategy, it's possible to setup the test using the platform you prefer. This usually involves choosing the cryptocurrency pair you want to trade as well as setting the time frame for testing, as well as any other parameters that are specific to your particular strategy.

After you've setup the backtest, you can run it to see how your trading strategy might have performed over time. The backtester generates a report showing the performance of your trades, which includes the win/loss, profit, loss and various other indicators.

Examine the data: After you have run the backtest, it's possible to analyze the data and see how your strategy performed. The backtest results can assist you in changing your strategy to increase its effectiveness.

Forward-test the Strategy It is possible to test your strategy using the use of a demo account or even with a tiny amount real money. To test how it works when trading takes place in real-time.

You will gain valuable information from a backtester who utilized crypto trading to test the effectiveness of your plan. These insights can be used to enhance your trading strategy. Follow the recommended crypto trading backtester for more tips including cryptocurrency margin trading, amibroker automated trading afl, interactive brokers auto trading, true trader review reddit, etoro sell crypto, aluna crypto, cryptotraders, automated trading software robinhood, apps to trade cryptocurrency, coinrule limited, and more.

How Do You Analyze The Results Of Backtesting To Assess The Risk And Profitability Associated Strategies For Trading?

Analyzing backtesting outcomes is critical to determine the financial viability of a plan to trade. In order to analyse the backtesting results, you follow these steps to calculate the performance metrics. This is the first step to analyze the results of backtesting. This involves calculating performance metrics such as the total return, the average return, and the maximum drawdown. These are the metrics used to determine the profitability and risk related trading strategies.

Compare to benchmarks. This lets you evaluate the performance of your trading strategy against benchmarks such as S&P 500 or market indexes. It also gives an indicator of how it performed against the overall market.

Evaluate risk management tools: Consider the risk management methods in your trading strategy. Examples include stop loss orders, and positions sizing. To determine the effectiveness of these tools in reducing the risk,

It is important to look for patterns or trends. Review the strategy's results at a regular interval to identify patterns or trends. This will allow you to determine areas that require improvement.

Market conditions: Review the market conditions, like liquidity and volatility, during the backtesting phase to determine how the strategy performed.

Backtest the strategy using a variety of parameters: To determine the strategy's effectiveness under various conditions, backtest the strategy with different parameters.

Change the strategy whenever necessary: Based upon backtesting analyses, adjust your strategy as needed to improve performance or reduce the risk.

In the end, analysing the results of backtesting requires a thorough examination of results indicators, risk management methods as well as market conditions and other elements that impact the profitability and risk of a trading strategy. Backtesting results can help traders identify areas that need improvements and adapt their strategies accordingly. View the top divergence trading for site advice including day trading forums usa, pionex smart trade, automated swing trading software, fully automated trading bot, tradingview robot trading, newton crypto exchange, auto trade binance, auto trade stock options, crypto futures trading, best forex forums, and more.

How Can You Best Analyze The Trading Of Divergence Using An Rsi Divergence Cheat Sheet?

Analyzing divergence trading using an RSI divergence cheat sheet involves the detection of possible buy or sell signals based on the divergence between the price and the RSI indicator. These are the steps you should take: Learn about RSI Divergence: RSI Divergence is when the price of an asset and its RSI indicator are in opposing directions. Bullish divergence means that the price is decreasing, however the RSI indicator is rising. Bearish divergence happens when the price is making higher highs while the RSI indicator is making lower highs.

Make use of an RSI Diligence Cheat Sheet. There are many cheat sheets to assist you in identifying the potential for buy or sell signals that are based on RSI diversification. A bullish divergence Cheat Sheet may suggest buying when RSI crosses above 30 and price is reaching the higher bottom, while the cheatsheet for bearish diversgence could suggest selling when RSI is below 70 and the price has made a lower high.

Recognize Potential Buy and Sell Signals. You might buy the asset when there is the sign of a bullish divergence in the chart. Conversely an indication of bearish could indicate that you should sell the asset.

Verify the Signal You could, for instance, be looking for confirmation using other indicators, such as moving averages, support and resistance levels.

Manage the risk: RSI divergence trading is similar to any other strategy for trading. This could include setting stop-loss orders in order to reduce the risk of losses, or changing position sizing based on risk tolerance.

The process of analyzing divergence trades with an RSI diversion cheat sheet is basically identifying potential buy/sell signals based the divergence between RSI indicator's price, and then confirming the signal with other technical indicators or using price action analysis. It is important to take care to limit the risk associated with this strategy and to thoroughly test it using data from the past before using it for live trading. See the recommended divergence trading for more recommendations including ftx margin lending, robo software for share market, automated trading companies, binance automated trading, free stock trading chat rooms, top cryptocurrency platforms, automated trading systems for tradestation, galileo fx automated trading, automated trading binance, auto buy sell trading software, and more.

[youtube]mII4WabEtGM[/youtube] |

|

| Návrat nahoru |

|

|

|

|

Nemůžete odesílat nové téma do tohoto fóra.

Nemůžete odpovídat na témata v tomto fóru.

Nemůžete upravovat své příspěvky v tomto fóru.

Nemůžete mazat své příspěvky v tomto fóru.

Nemůžete hlasovat v tomto fóru.

|

|